The size of a property is one of the most significant factors that influence its value. Larger properties are generally more valuable than smaller ones, all other things being equal. The reason for this is simple: larger properties provide more space, which is a desirable feature for many buyers.

However, the relationship between property size and value is not always straightforward. In some cases, a small property in a highly desirable location may be worth more than a larger property in a less desirable location. Similarly, the value of a property can be affected by other factors such as its age, condition, and features. Nonetheless, property size remains one of the most important factors in determining its market value.

The Impact of Property Size on Value

When it comes to determining the value of a property, size plays a crucial role. The larger the property, the higher its value is likely to be. However, the impact of property size on value can differ depending on various factors.

Square Footage

The square footage of a property is one of the most critical factors that determine its value. The larger the square footage, the higher the value of the property is likely to be. However, the value of a property is not solely based on its square footage. Other factors such as location, condition, and amenities can also impact the value of the property.

Lot Size

Lot size is another important factor that can impact the value of a property. A larger lot size can increase the value of a property, especially in areas where land is scarce. However, in some regions, smaller lot sizes may be more desirable, especially in areas where compact properties are more popular.

When evaluating the impact of lot size on property value, appraisers take into account various factors such as zoning regulations, utility access, and topography.

Property Size

The overall size of a property, including both the square footage and lot size, can have a significant impact on its value. In regions where larger properties are in high demand, the value of the property may increase. However, in regions where smaller, compact properties are more popular, the value of the property may be less dependent on its size.

Value

The value of a property is determined by various factors, and size is just one of them. Other factors such as location, condition, and amenities can also impact the value of the property. When evaluating the value of a property, appraisers take into account all of these factors to determine the fair market value of the property.

In conclusion, the size of a property can have a significant impact on its value, but it is not the only factor that determines its value. When evaluating the value of a property, it is essential to consider all of the relevant factors to determine its fair market value.

Location and Neighborhood

When it comes to the value of a property, location and neighborhood are two of the most important factors to consider. The location of a property can significantly impact its value, and it’s not just about the physical address. The neighborhood and surrounding area can also have a big influence on a property’s worth. Here are some of the key factors to consider when it comes to location and neighborhood:

Proximity to Amenities

The proximity of a property to amenities can have a significant impact on its value. Properties that are located close to shopping centers, restaurants, parks, and other amenities are generally more desirable and valuable than those that are located further away. This is because people are willing to pay more for the convenience of having everything they need nearby.

Crime Rates

The crime rate in a neighborhood can also have a big impact on the value of a property. Properties located in areas with high crime rates are generally less valuable than those located in safer neighborhoods. This is because people are willing to pay more for the peace of mind that comes with living in a safe area.

School Districts

The quality of the local schools can also have a significant impact on the value of a property. Properties located in areas with good schools are generally more valuable than those located in areas with poor schools. This is because people are willing to pay more for the opportunity to send their children to good schools.

When it comes to location and neighborhood, there are many factors to consider. Proximity to amenities, crime rates, and school districts are just a few of the most important factors to keep in mind. By taking these factors into account, you can better understand how the location and neighborhood of a property can impact its value.

Condition and Upgrades

The condition of a property is one of the most significant factors affecting its value. A well-maintained property will generally have a higher value than one that has been neglected. Upgrades and renovations can also add value to a property. Here are some sub-sections to consider when evaluating the condition and upgrades of a property:

Renovation Potential

Properties with renovation potential can be a great investment opportunity. Renovations can add value to a property and make it more attractive to potential buyers. However, it is important to consider the cost of renovations and whether they will provide a good return on investment. An outdated kitchen or bathroom, for example, can be updated to increase the value of the property.

Energy Efficiency

Energy-efficient upgrades can also add value to a property. Improvements such as adding insulation, upgrading windows and doors, and installing energy-efficient appliances can save homeowners money on energy bills and make the property more attractive to buyers. Energy-efficient upgrades can also help reduce the property’s carbon footprint, which is becoming increasingly important to many buyers.

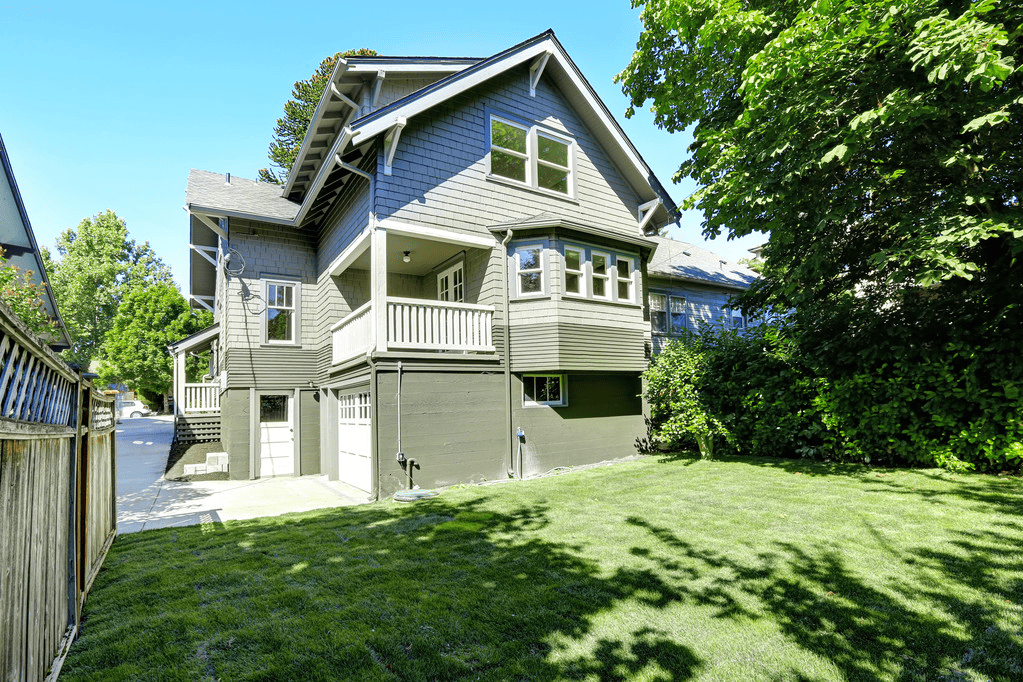

Curb Appeal

The exterior of a property is the first thing potential buyers see, so it is important to make a good impression. Curb appeal can be improved by updating the landscaping, adding a fresh coat of paint, and making repairs to the exterior of the property. A well-maintained exterior can increase the value of a property and make it more attractive to buyers.

Overall, the condition and upgrades of a property can significantly affect its value. Renovation potential, energy efficiency, and curb appeal are all important factors to consider when evaluating a property. By making upgrades and maintaining the property, homeowners can increase its value and make it more attractive to potential buyers.

Market Factors

When it comes to determining the value of a property, there are many market factors that come into play. In this section, we will explore some of the key market factors that affect the value of a property.

Supply and Demand

One of the most important market factors that affects the value of a property is the balance of supply and demand in the real estate market. When there is high demand for properties and limited supply, prices tend to rise. Conversely, when there is an oversupply of properties and limited demand, prices tend to fall.

Interest Rates

Interest rates also play a significant role in determining the value of a property. When interest rates are low, borrowing money to purchase a property is more affordable, which can drive up demand and prices. Conversely, when interest rates are high, borrowing money to purchase a property becomes more expensive, which can lower demand and prices.

Economic Outlook

The overall state of the economy can also have a significant impact on the value of a property. When the economy is strong and people are feeling confident about their financial situation, they are more likely to invest in property, which can drive up demand and prices. Conversely, when the economy is weak and people are feeling uncertain about their financial situation, they may be less likely to invest in property, which can lower demand and prices.

Other factors that can influence the value of a property include population growth, demographics, and market outlook. By considering these market factors, you can gain a better understanding of how the size of a property can affect its value.

Comparables and Appraisals

When it comes to determining the value of a property, one of the most important factors to consider is the size of the property. However, it’s not just the size of the property that determines its value. Other factors such as location, condition, and amenities can also play a significant role. In this section, we will explore how comparable properties, home appraisals, and property taxes can help determine the value of a property.

Comparable Properties

One of the best ways to determine the value of a property is to look at comparable properties in the same area. Comparable properties, or “comps,” are properties that are similar in size, condition, and location to the property being evaluated. By comparing the prices of these properties, appraisers can get a good idea of what the property is worth.

When looking at comps, it’s important to consider factors such as the size of the property, the number of bedrooms and bathrooms, and any additional amenities such as a garage or swimming pool. It’s also important to consider the condition of the property and any recent renovations that may have been done.

Home Appraisal

Another important factor to consider when determining the value of a property is the home appraisal. A home appraisal is an evaluation of a property’s value by a licensed appraiser. The appraiser will consider factors such as the size of the property, the condition of the property, and any recent renovations that may have been done.

During the appraisal, the appraiser will also look at comparable properties in the same area to get an idea of what the property is worth. Once the appraisal is complete, the appraiser will provide a report that outlines the appraised value of the property.

Property Taxes

Property taxes are another factor to consider when determining the value of a property. Property taxes are based on the assessed value of the property, which is determined by the local government. The assessed value is usually based on the market value of the property, which is determined by looking at comparable properties in the same area.

It’s important to note that the assessed value of a property may not always be the same as the appraised value or the market value. However, property taxes can still provide a good indication of the value of a property.

In summary, determining the value of a property is a complex process that involves looking at a variety of factors. By considering comparable properties, home appraisals, and property taxes, appraisers can get a good idea of what a property is worth. However, it’s important to remember that the value of a property can fluctuate over time based on a variety of factors, including market conditions and changes to the property itself.

Working with Real Estate Agents

When it comes to buying or selling real estate, working with a real estate agent can be a valuable asset. Real estate agents can help you navigate the complex process of buying or selling a property, and they can provide you with valuable insights into the local real estate market. However, not all real estate agents are created equal, and it is important to find the right agent for your needs.

Finding the Right Agent

Finding the right real estate agent can be a daunting task, but it is important to take the time to find an agent who is a good fit for your needs. Look for an agent who has experience in your local market and who has a track record of success. You can also ask for referrals from friends and family members who have worked with real estate agents in the past.

Working with Your Agent

Once you have found the right real estate agent, it is important to establish a good working relationship with them. Be clear about your needs and expectations, and be open to their advice and suggestions. Your agent can help you find properties that meet your criteria, negotiate offers, and guide you through the closing process.

Ethics

Real estate agents are bound by a strict code of ethics, which requires them to act in the best interests of their clients. This means that they must be honest and transparent in their dealings, and they must always put their clients’ needs first. If you have concerns about the ethical conduct of your agent, you can file a complaint with the appropriate regulatory body.

In conclusion, working with a real estate agent can be a valuable asset when buying or selling a property. By finding the right agent, establishing a good working relationship, and ensuring that your agent is acting ethically, you can navigate the complex process of real estate with confidence.

Conclusion

In conclusion, the size of a property is a significant factor that affects its value. The larger the property, the higher its value, all other things being equal. However, the size of the property is not the only factor that determines its value. Other factors such as location, condition, and features also play a crucial role in determining the value of a property.

When considering the size of a property, it is essential to keep in mind that usable space is more important than total square footage. A large property with a lot of unusable space may not be worth as much as a smaller property with a more efficient layout. Therefore, it is essential to consider the usable space when evaluating the size of a property.

It is also important to keep in mind that the value of a property is not solely determined by its size. Other factors such as location, condition, and features also play a crucial role in determining the value of a property. A property in a desirable location with excellent features and in good condition may be worth more than a larger property in a less desirable location.

In summary, the size of a property is an important factor that affects its value, but it is not the only factor. When evaluating the value of a property, it is essential to consider other factors such as location, condition, and features. By taking all of these factors into account, you can determine the true value of a property.